PRICE ACTION

It mainly predicts future trends through patterns and trends. Since past prices have strongly predicted the trajectory of price trends, chartists also have a famous saying, TREND IS YOUR FRIEND. Before understanding what a trend is, investors generally learn to look at candlesticks, support, resistance and trend lines.

Candlestick

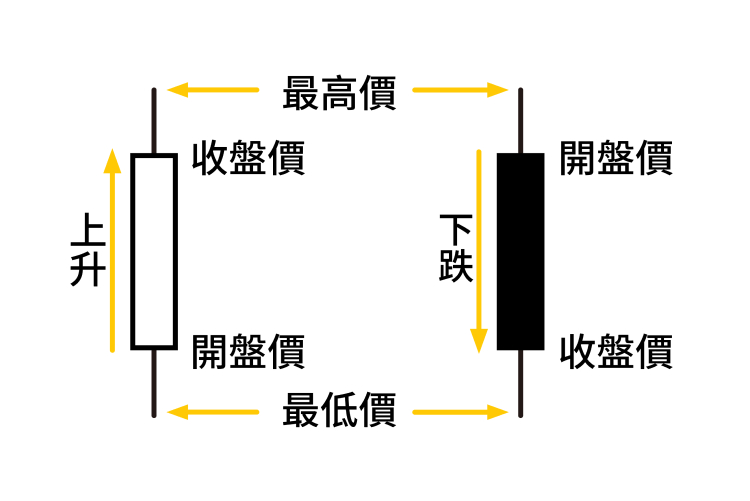

The picture shows the explanation of the white candlestick and the black candlestick

The picture shows the explanation of the white candlestick and the black candlestick

The candlestick will record the opening, closing, high and low price changes of each period. The white candlestick represents the rising market at that time, and the black candlestick represents the falling market. The upper part of the candle body is called the upper shadow, and the lower part of the candle body is called the lower shadow. ; Each time period can be changed to every minute, hour, daily, weekly, quarterly, yearly, which can be selected according to the short-term or long-term market entry needs of investors. The combination of the candlestick itself will also make some patterns to indicate future price changes.

Candlestick pattern

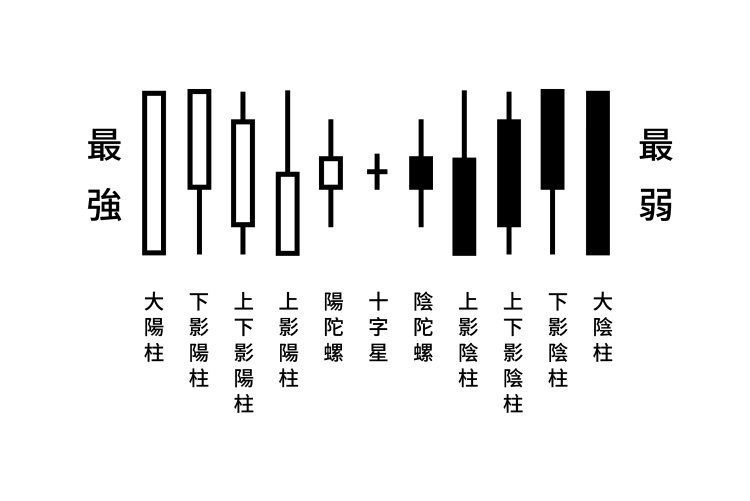

The pattern of a single candlestick

The pattern of a single candlestick

The Doji is a reversal pattern. If a Doji appears after a big rally, the market outlook is expected to fall, and vice versa, if a Doji appears after a big drop, the market outlook is expected to rise. The big white candlestick is the strongest signal, and the market outlook can continue to rise. The big black candlestick is the weakest signal, and the market outlook is bearish.

Candlestick combination

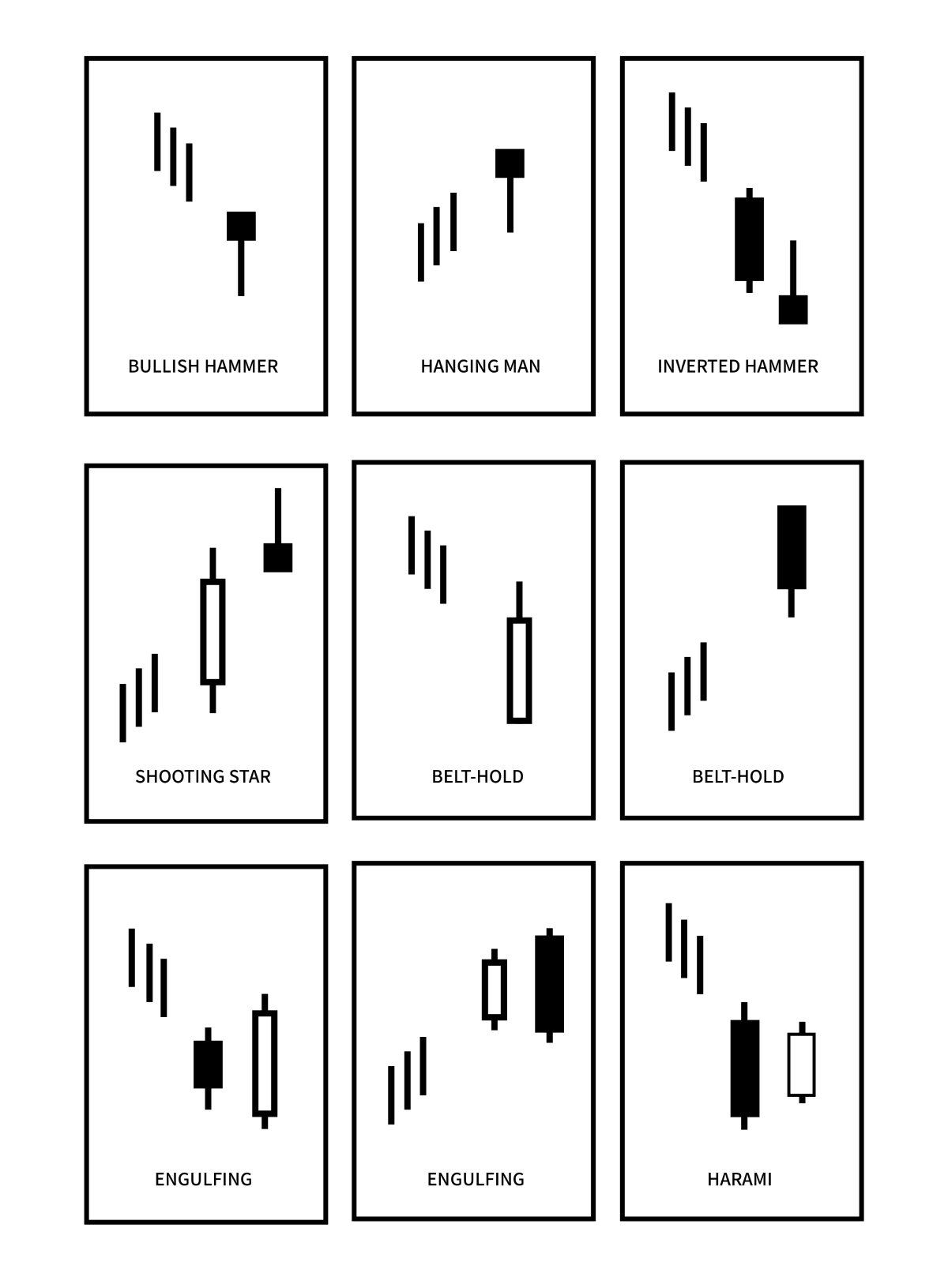

An example of a candlestick combination

An example of a candlestick combination

Combining two or more consecutive candlesticks can become a combination to predict the future performance of the market. There are several groups of examples below:

| Bullish Harami | A small white candlestick appears after a black candlestick | See support at the bottom, buy signal |

| Bearish Engulfing | After a white candlestick, the next black candlestick rises first and then falls through the opening price of the white candlestick | High under-buy support, turnaround and sell signal |

| Morning Doji star | Doji appears after consecutive black candlesticks | Turnaround signal, the market outlook is positive |

| Reverse | A black candlestick opens higher after a white candlestick without a shadow | Peak signal, need to sell regardless of price |

| Bearish Engulfing | Big white candlestick followed by big black candlestick | Peak signal, need to sell regardless of price |

| Three White Soldier | Three white candlesticks appear one after another | The market outlook is good, you can buy with the trend |

| Climbing Stair | Multiple white candlesticks mixed with black candlesticks, but the black candlestick closed higher than the white candlestick opened | The market outlook continues to improve, and you can buy every time you take back |

Support and resistance

The support line refers to the line that connects the lower shadow of two or more candlesticks or the lower part of the body of the candle, which will form support, while the resistance line refers to the upper shadow of two or more candlesticks. Lines or lines that are connected together above the body of a candlestick, where resistance is formed. When the candlestick is overcast, it can also be connected by K line and BAR CHART. When the price is close to the support line, you should buy it, and when it is close to the resistance level, you should sell it.

Trend

When the support and resistance lines are drawn, the two lines can move upward in a balanced manner, forming an upward trend, which is called an ascending channel. The market outlook can continue to improve, and it indicates that it will continue to be stable in this channel in the short term. Up, you can buy every time the price retreats. When the two lines are balanced and synchronized downward, a downward trend will be formed, which is a downward track, and the market outlook will gradually decline.

Breakthrough

The picture shows the falling resistance line, technical resistance becomes support

The picture shows the falling resistance line, technical resistance becomes support

The most important principle in PRICE ACTION is that when the price rises and crosses the resistance line, or falls below the support line, it is regarded as a breakthrough signal, and the price will extend the uptrend or extend the downside accordingly. Breaking through the resistance line, the resistance will turn into support; if it falls below the support line, the support will turn into resistance; some patterns can measure its magnitude to predict the target price of the uptrend or downtrend and it can be applied to other forms.

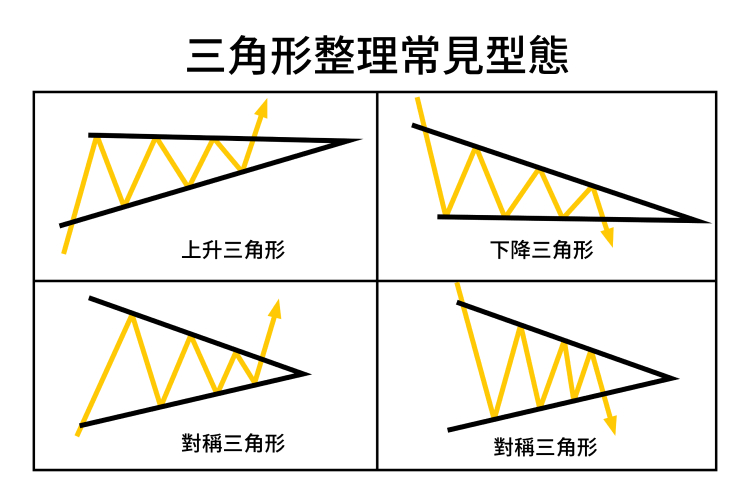

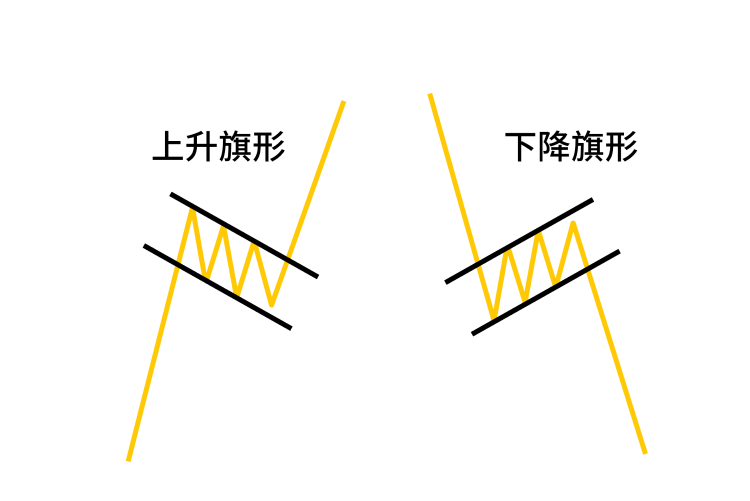

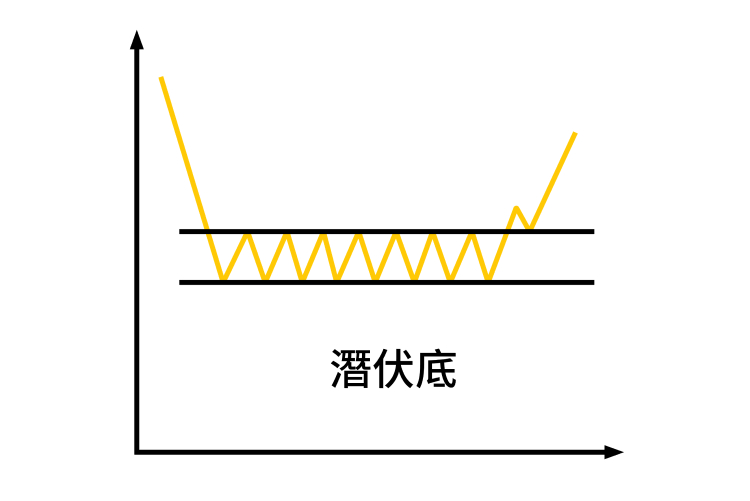

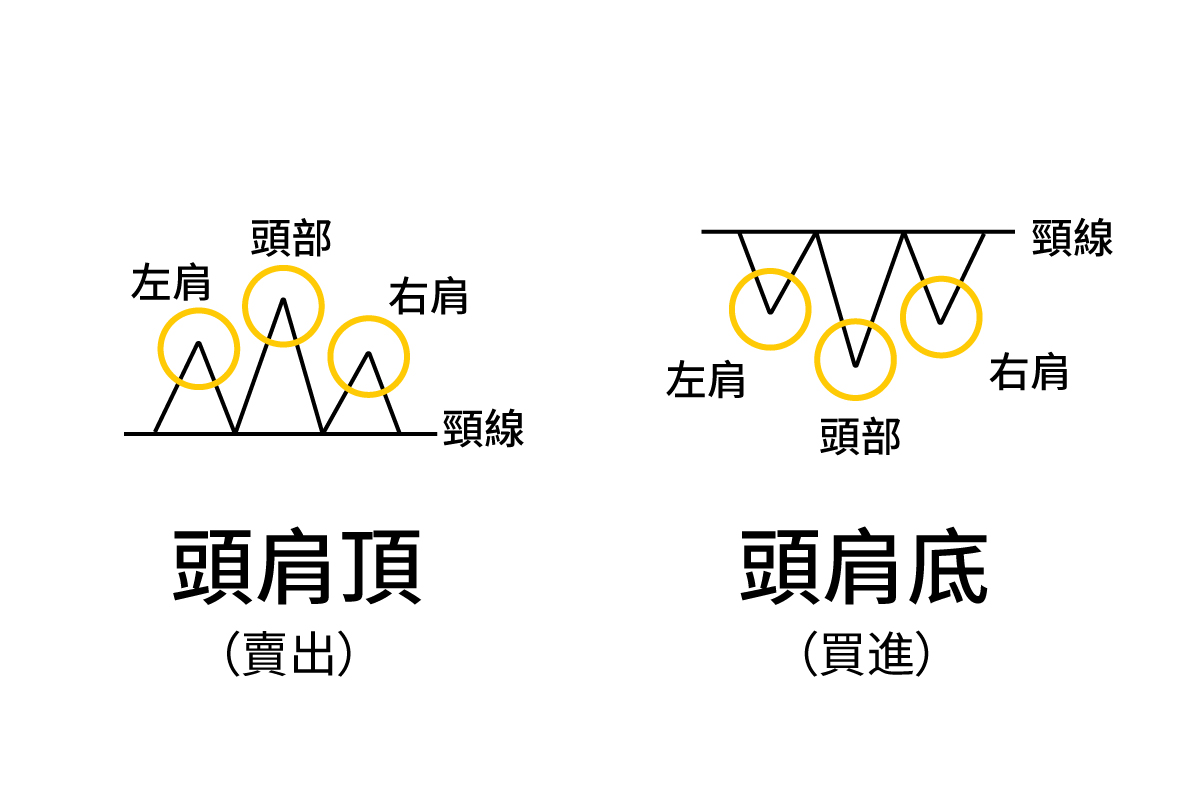

Breakthrough examples of the line combination of different forms

Breakthrough examples of the line combination of different forms

| Triangle | The price volatility narrowed, the support continued and the most resistance line intersected | Buy when the resistance is broken, and sell when the support line is broken. The target is the breakout position plus the range of the end of the triangle. |

| Flag | Up/down flagpole plus short up/down rail at the end of the flagpole | Buy when the resistance is broken, and sell when the support line is broken. The target is the breakout position plus the magnitude of the flagpole. |

| Latent bottom | Long-term breakthrough at the bottom | Buy after breaking the resistance, target three to ten times the bottom of the sideways |

| Head and shoulders | The left and right shoulders need to be close to symmetry, and the head should be at least half of the two shoulders, rising/falling through the neckline to break through | After the breakthrough, there may be a life-saving pump or it may not appear at all. Buy/sell immediately at the neckline position |

ELLIOTT WAVE PRINCIPLE

The wave theory is one of the most important applied theories in technical analysis. It uses several waves to predict the stage of the price, the upper extension space and the lower withdrawal level, and the market is expected to be in a bull market or a bear market. The theory was proposed by American economist RALPH NELSON ELLIOTT, so it is also called Elliott Wave Theory.

The theoretical assumption is that there is a specific pattern in the price trend of the market. Therefore, its law can be determined in accordance with the proportion and time, and transactions can be carried out within this law. The rules include:

- Wave 2 cannot fully retract wave 1

- Wave 3 cannot be the shortest of the driving waves

- The low of wave 4 cannot overlap the apex of wave 1

The different waves and all patterns of the wave theory

The different waves and all patterns of the wave theory

Wave 1

Prices rose for the first time. Often it is because a small wave of people think the price is cheap enough to buy and actually buy a portion of the product in a very short period of time, causing the price to go up.

Wave 2

Some people who already owned the product thought the price was too high and took profits, which in turn caused the stock price to fall. But the price did not hit the bottom of wave 1.

Wave 3

This is usually the strongest and longest wave. The product caught the attention of the public, and more people saw the potential of the product and started to buy, which led to a continued climb in price. The high of this wave broke above the high of wave 1.

Wave 4

Some people think the price is too high and start taking profits. This wave is usually not too strong, because there are more people who are bullish on the rally of the product.

Wave 5

Wave 5 is usually the moment when the vast majority of people in the market focus on the product, and it's usually less rational. People may see that the media often report about the product, and the price change has become a hot topic in the market, and almost all people are optimistic. People started buying for all sorts of weird reasons and turning a deaf ear to other people's persuasion, which in turn made the price significantly overvalued.

Wave A

Wave A is the beginning of a downtrend, but most investors believe that the uptrend has not been reversed and is only a temporary pullback. In fact, the decline of wave A usually has warning signals in wave 5, such as the deviation of volume and price trend or the deviation of technical indicators, but because the market is still relatively optimistic at this time, wave A sometimes has a platform adjustment.

Wave B

Wave B is a rebound on wave A, but with little volume. Generally speaking, it is the escape line for bulls, but because most investors mistakenly believe that it is another wave of gains, wave B often forms a "bull trap", where investors are trapped. Wave B is rarely technically strong, and the number of stocks active in wave B is limited, but blue-chip stocks are quite resilient.

Wave C

The C wave is a falling wave with strong destructive power.

INDICATOR

Technical indicators are statistics based on past data, and calculated using different parameters and formulas. There are many different technical indicators in the market. This kind of introduction will introduce some of the more commonly used ones, and try to explain and operate them.

| Moving average | Calculate the most recent average closing market value in different time periods, and connect the daily averages together to form an average line | The moving average itself is the support and resistance position. Generally, the 250-day moving average is the dividing line between bulls and bears. In addition, when the fast line crosses the slow line, a golden cross or a death cross occurs, which is also a buy or sell signal. |

| RSI | Calculate a value with a specific formula, and the commonly used parameters are 9 and 14 days. The value is between 0 and 100 | When the value is above 50, it means that the market conditions are improving, if it is below 50, it will be weak, if it is above 80, it is overbought, and if it is below 20, it is oversold. If there is a divergence phenomenon, it is expected that the price will fall, and vice versa |

| MACD | It consists of two lines, generally using 12 and 26 as parameters, and the value calculated by the average line fluctuates up and down the central axis 0 | When it rises above 0, it is a positive signal; when it falls below 0, it is a bearish signal; it can also be used with the trend chart to determine whether there is a divergence phenomenon |

| Bollinger Bands | Composed of three lines, based on the concept of average and standard deviation, the price will run within the channel | The three lines themselves are support and resistance levels for market conditions. Above the central axis is a bull market, and below it is a bear market. If the Brigitte Channel narrows first and then moves up or down rapidly, there will be a unilateral movement in the forecast market conditions. |

| Fibonacci number | Taking the magic number as the concept, divided into golden ratio, 0.382 and 0.618 are the rebound targets. | The ratio of the magic number will become a support or resistance level. For example, after the price peaks from 1 to 100, the take-back target will be supported at 38.2 and 61.8, and then the uptrend will be restructured. |

Whatsapp

Whatsapp Telegram

Telegram