Gold prices may need to reach $5,000 before stabilizing.

"Gold Price May Test $5,000 Before Stabilizing" 30/1/2026 10:45 Finalized

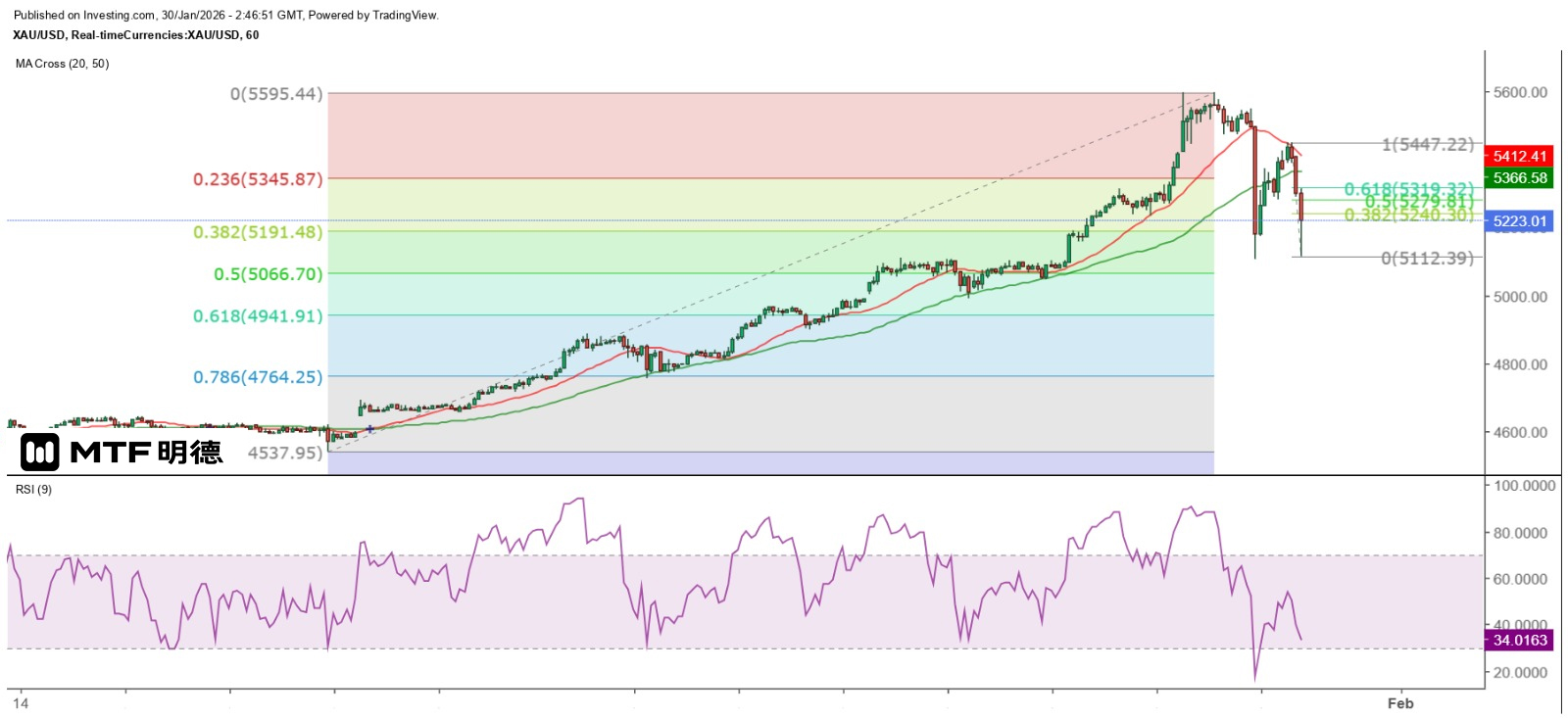

Gold and silver witnessed a perfect storm yesterday. The spot gold price reached a high of $5,595.41 in the Asian market, then pulled back to a low of $5,446.64 before rebounding. It hit a new high of $5,595.44 in the early European market, although it formed a double top pattern. Subsequently, it dropped again. In the early New York market, the gold price started to fall from $5,549.48, and the decline was extremely sharp, hitting a low of $5,104.6, which means a single-day drop of nearly $491, the largest ever!

Subsequently, the gold price began to rebound. From the hourly chart, it can be seen that the gold price slightly broke above the 20SMA (currently around 5408.2) in the early Asian session today, but then fell again, with a sharp decline, reaching a low of 5112.39 US dollars before starting a more substantial rebound. From a technical perspective, a double bottom pattern was formed at the 5100 US dollar level, and 5110 US dollars is the 135-degree angle of the Gann Square, which is a relatively strong support or resistance level. In other words, the gold price may temporarily stop falling and fluctuate above 5100 US dollars. However, the decline in the Asian session has been so strong that the possibility of a significant sell-off in the European and New York sessions is very high. Additionally, if the gold price breaks below 5100 US dollars, the stronger support level is at 4960 US dollars, and 5000 US dollars should be a key level for bulls to defend. Therefore, it is temporarily judged that the gold price can still fluctuate above 5000 US dollars.

According to a report by the World Gold Council, last year, gold investment demand surged by 84% to 2,175.3 tons, but the amount of gold purchased by global central banks decreased by 21% to 863.3 tons. Analysts from the World Gold Council predict that this year, the amount of gold purchased by central banks may decrease by 200 to 250 tons compared to last year. Central banks have never been the main driving force behind the rise in gold prices; instead, it is investment demand. In other words, the two sharp drops in gold prices yesterday and this morning were likely caused by investors. Could it be that they are significantly reducing their holdings and then accumulating good positions at lower levels? However, I believe that the lowest point for today has not yet arrived. $5,280 is expected to be the first major resistance level for the day. If it falls below $5,100, it is likely to drop to $5,066 or $4,942 before stabilizing.

The above content is for reference only and does not constitute investment advice.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram