economy Soft landing or hard landing?

The Federal Reserve's meeting on interest rates in September is just around the corner. Investors are most worried about the rapid interest rate hike in the United States, which will lead to a "hard landing" of the economy and impact the economy and investment market. What are the hard landing and soft landing that we often hear recently?

Soft landing refers to:

After adjusting the monetary policy moderately, the economy returned to the moderate growth range moderately and steadily, and there was no large-scale unemployment or economic recession in the process, just like the plane slowed down and landed slowly. Although the interest rate hike did harm to the economy, the damage was not great, and the overall economy still held on to growth. The flatter the downward trend, the more ideal the soft landing would be.

A hard landing means:

The use of strong monetary policy tightening means to reduce communication leads to a rapid decline in economic growth, accompanied by a decline in people's income and unemployment, just like a plane landing at high speed. Simply put, the hard landing is due to poor economic health or excessive interest rate increase, which leads to more severe economic damage!

Definition of soft and hard landing (Federal Reserve of new york, USA)

"Soft landing": The annual economic growth rate has remained positive in four quarters in the last 10 quarters.

"Hard growth": In the next 10 quarters, the annual economic growth rate will be-1% or less.

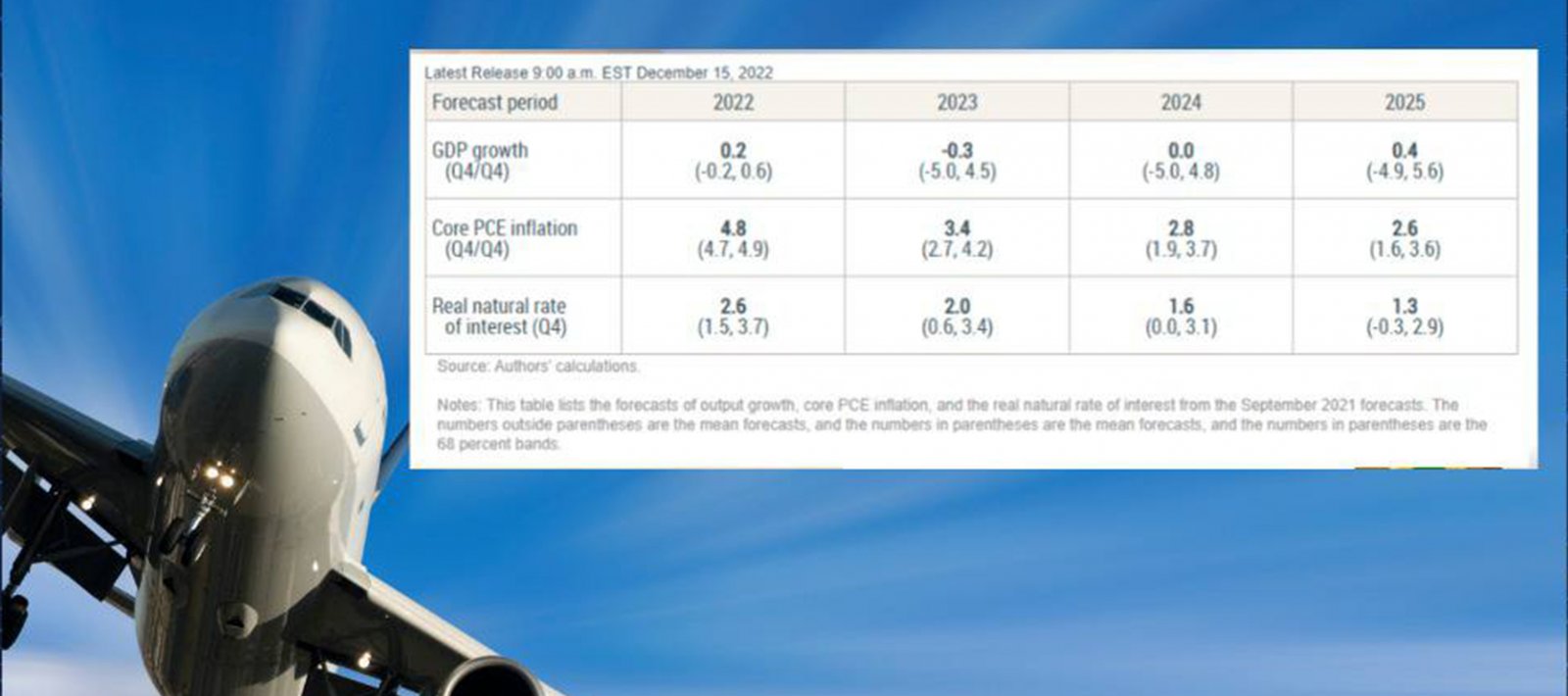

At the same time, American officials will use DSGE model to predict soft and hard landings. In December 2022, the Federal Reserve Bank of New York predicted that the average GDP in the next four years will be mostly positive, and the chance of soft landing is high.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram